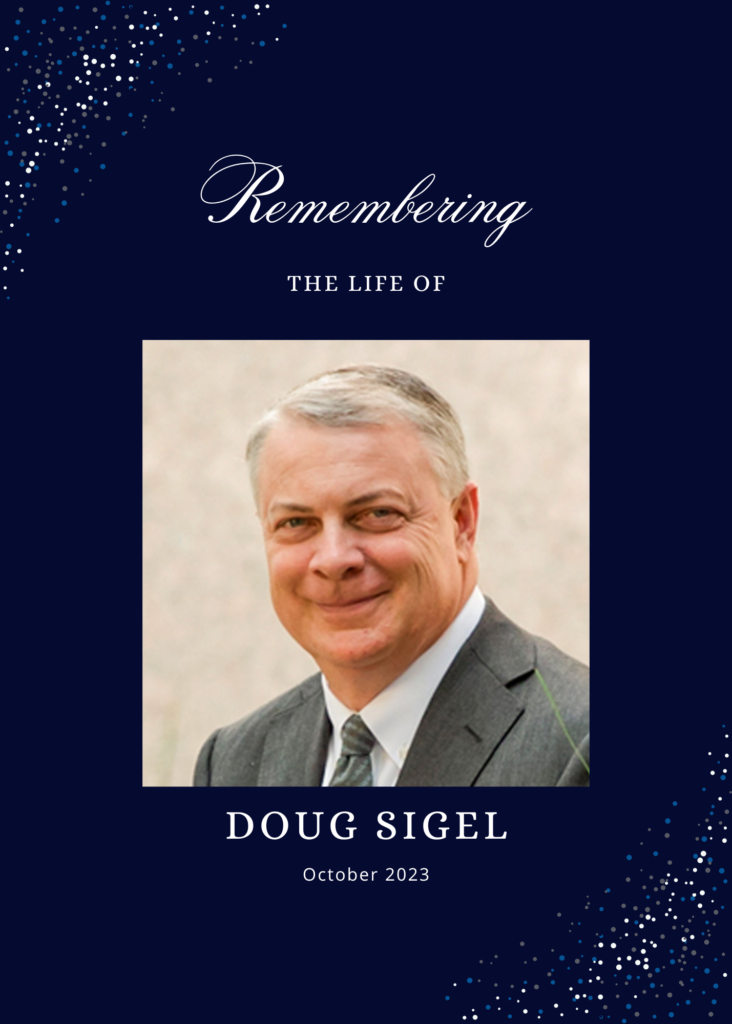

With a heavy heart, we remember Doug Sigel, Partner and Practice Group Leader for the Sales & Use and Income Tax team out of Austin, Texas, who unexpectedly passed away.

With a heavy heart, we remember Doug Sigel, Partner and Practice Group Leader for the Sales & Use and Income Tax team out of Austin, Texas, who unexpectedly passed away.

Doug was a titan in the transaction and income tax world, and his expertise and dedication to his clients were unmatched. He was a leader in the industry and a mentor to many young attorneys.

Doug was passionate about his work and always looked for ways to improve his practice. He was also a great advocate for his clients and fought tirelessly to protect their interests.

Doug’s passing is a significant loss to the legal community and everyone who knew him. He will be deeply missed.

Our thoughts and prayers go out to Doug’s family during this difficult time.

More about Doug Sigel

Doug Sigel has 29 years of experience litigating and settling disputes in hearings and courts across the country. His practice focuses on federal, state, and local taxation, with an emphasis on litigation at the administrative, trial, and appellate levels. Examples of the types of matters Doug handles include sales and use tax, state corporate income tax (including the Texas margin tax), Texas property tax, motor vehicle sales tax, oil and gas severance tax, insurance tax, motor fuels tax, mixed beverage tax, unclaimed property, tax credits/incentives, nexus disputes, audits, hearings, trials and appeals, tax collection cases, voluntary disclosure agreements, letter rulings, and open records requests.

Doug handles his docket of administrative, district court, and appellate cases in an aggressive yet efficient manner and always seeks the best outcome possible for his clients. Doug strives to streamline the resolution of his cases through innovative approaches tailored for each individual case. Doug creates innovative and unique strategies for each of his cases by first gaining a thorough understanding of the issues, personalities, and facts early in a dispute. With this foundation, Doug crafts a strategy to achieve an expedited settlement of the dispute through a collaborative interaction with counsel for the taxing authority. If necessary, Doug will take the case to trial as quickly as possible and leverage the strengths of the taxpayer’s position and evidence to present the taxpayer’s argument in a focused and creative manner.

Doug has spoken on a variety of sales and use and income tax topics at seminars sponsored by IPT, COST, TEI, The Hartman Forum, the Texas Society of CPAs, the Tulane Tax Institute, the State Bar of Texas, the National Association of State Bar Tax Sections, and the ABA Tax Section. He is also a frequent author on federal, state, and local tax topics. For example, Doug has authored a chapter for the IPT Income Tax Deskbook published in 2012.

Doug is on the executive board of the federal, state, and local tax committee of the ABA tax section. He is IPT’s overall chair for sales tax. He was the chair of the 2014 IPT Sales and Use Tax Symposium and is on the planning committee for the 2015 ABA/IPT Sales Tax Seminar. He is also the chair of the National Association of State Bar Tax Sections.

Ryan Law

Ryan Law